Report on the conservative segment

It has been a little over four years since the conservative segment was created, and following the extreme volatility encountered recently on the financial markets, we felt it was time to report on the portfolio’s performance, to make sure that it has fulfilled its objectives and still meets the needs of the beneficiaries.

Created in late 2004, the conservative segment (B share) invests essentially in bonds and fixed-revenue instruments, to offer an alternative to beneficiaries who wish to protect part or all of their assets against market volatility during their last two years of affiliation. Beneficiaries aged 55 and over can invest in this segment on a voluntary basis, with subscriptions open once a year (at the end of the calendar year for the following year). Beneficiaries decide each year whether they want to invest in the conservative segment, and if so, how much. It is important to understand that the subscriptions are irrevocable, since once the investments are transferred to the conservative segment, they cannot be returned to the traditional growth segment. The reasoning behind this is to protect the beneficiaries against the speculative risks entailed in frequent changes in investment strategy based on market fluctuations.

As illustrated in the graph below, the sharp decline in the stock market in 2008 shows that CPIC’s traditional portfolio is heavily exposed to market volatility. For example, a beneficiary who was 64 years old at the end of 2007, with accumulated assets of 500,000 Swiss francs, and who planned to retire on 31 December 2008 would have lost 20% of his capital, or 100,000 Swiss francs, in just one year. The conservative segment (B share), however, though it did not participate in the bull market from 2005 to mid 2007, did preserve asset value from the second half of 2007 through the first quarter of 2010.

Whether expressed in Swiss francs or Euros, the conservative portfolio has preserved asset value since it was created, and even generated a very small profit, unlike the traditional segment over the same period. This does not call into question the validity of the traditional segment, since the period overall was largely unfavourable for stocks. However, it does show how important it is to have a long-term strategy and at least a five year time-frame for funds invested in the traditional segment.

When the conservative segment was launched, the Management Board advised beneficiaries to switch their assets over gradually, whenever their time-frame allowed, to dilute the risk of bad timing. As shown in the graph below, a beneficiary who followed this advice and gradually transferred 20% of his assets per year starting in 2005 would have benefited from particularly good timing. He would have participated in the bull market during the first two years, and protected himself during the last two years by gradually moving into a more conservative portfolio position. The cumulative performance of his account would have been nearly 15%, whereas the two segments taken separately generated performances approaching zero over the period in question.

Of course, the final result of this type of transaction obviously depends on market performance over the period. Although this gradual strategy proved to be particularly advantageous from 2004 to 2010, there is no guarantee that the same will be true for the next five years. We are not suggesting that beneficiaries should use this exact strategy; we simply wanted to show the potential advantages of carefully planned, gradual transfers.

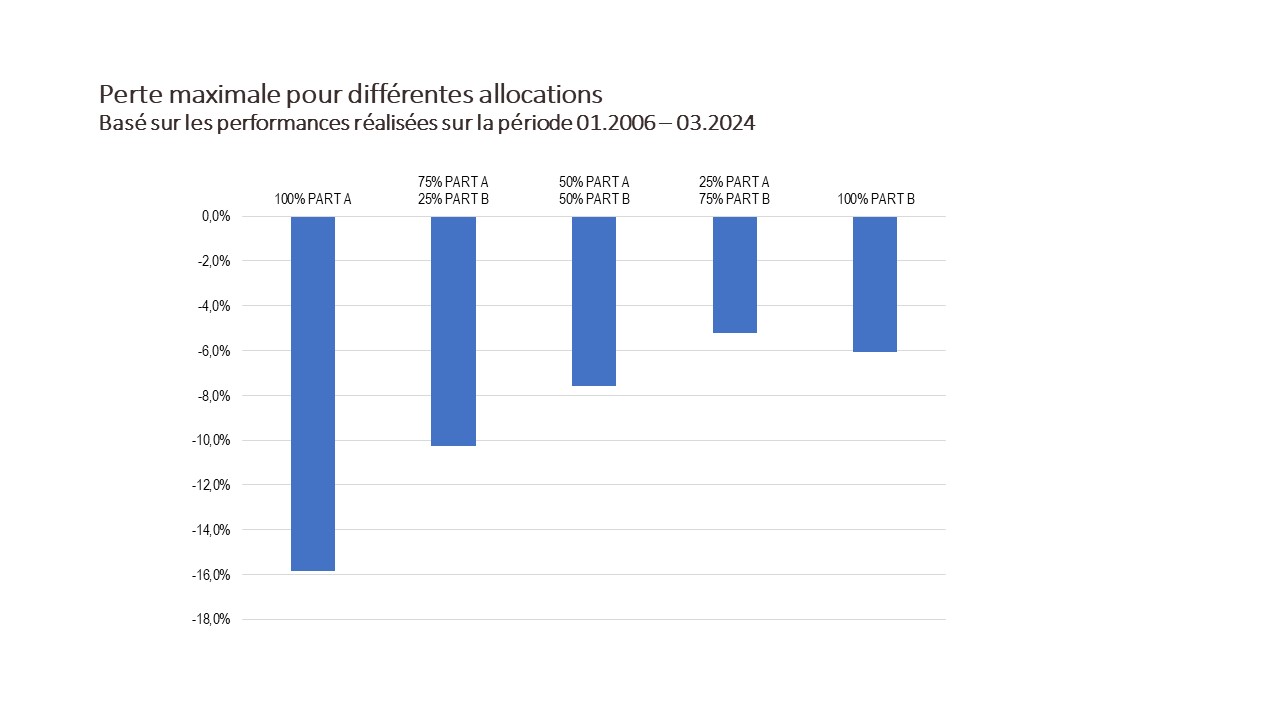

It is also important to point out that the choice between the traditional growth segment (A share) and the conservative segment (B share) should not be based on short-term market trends, but rather on each beneficiary’s individual circumstances and ability to tolerate financial risk.

CPIC’s traditional segment – the main segment – focuses on generating a return over the long term. It enables you to participate in economic growth through diversified investments, chiefly in stocks and bonds. Its expectation of a higher return is, however, accompanied by short-term volatility which can at times be significant, both upwards and downwards.

In contrast, the conservative segment, which is invested solely in bonds and fixed-income instruments, aims at preserving your assets by considerably limiting volatility, but with the expectation of a lower return